are funeral expenses tax deductible in california

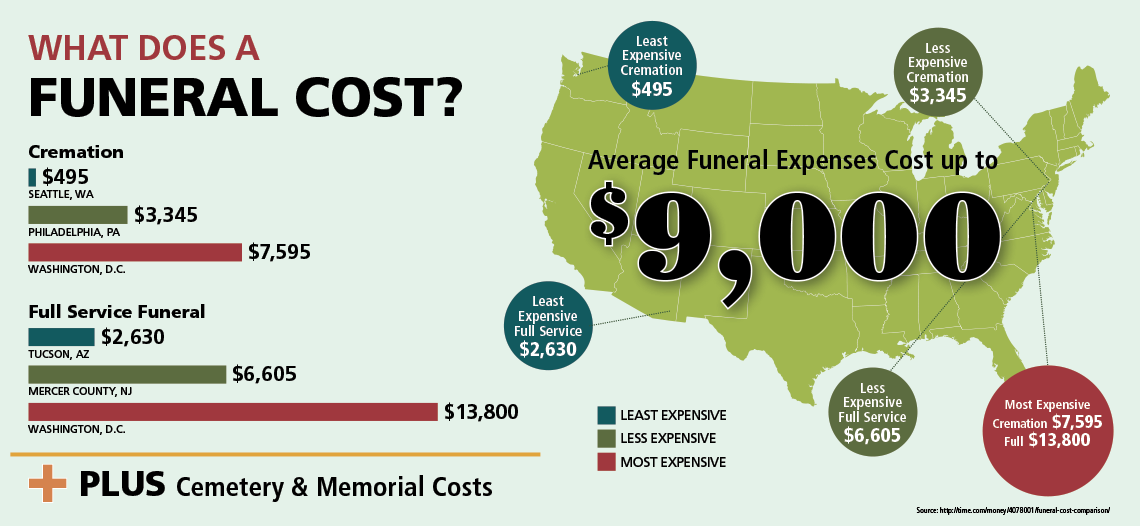

IRS rules dictate that all estates worth. Unfortunately funeral expenses are not tax-deductible for individual.

Are Funeral Expenses Tax Deductible

Medical and dental expenses.

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

. Deduction CA allowable amount Federal allowable amount. The state gets to collect sales tax on such personal property. In short these expenses are not eligible to be claimed on a 1040 tax.

Expenses that exceed 75 of your federal AGI. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. The amount of these exemptions can vary.

In order for funeral expenses to be deductible you would need to have paid. According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate. Qualified medical expenses include.

Some estates may be able to deduct funeral expenses. Are funeral expenses deductible on 1041. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses.

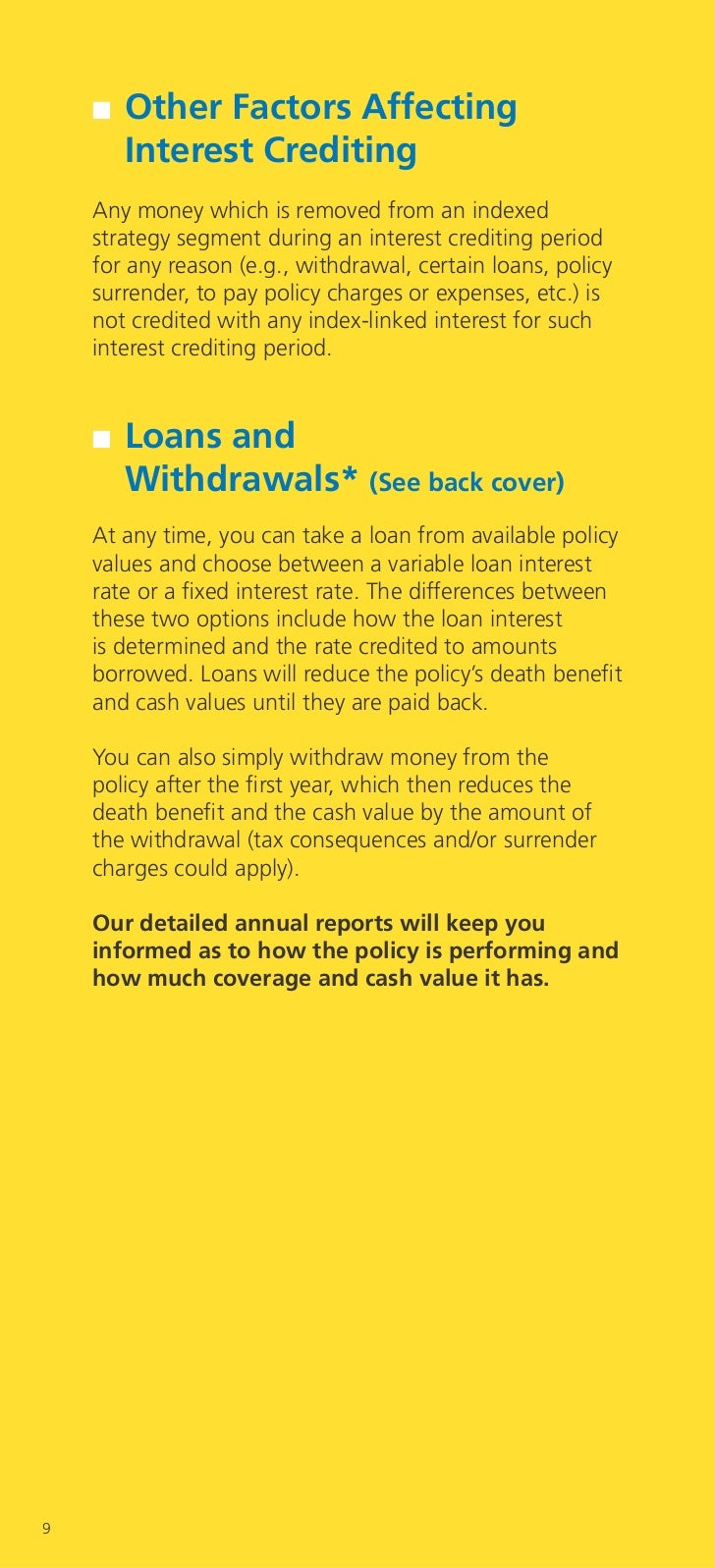

The IRS deducts qualified medical expenses. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates. Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. Individual taxpayers cannot deduct funeral expenses on their tax return.

Funeral Costs Paid by the Estate Are Tax Deductible. While the IRS allows deductions for medical expenses funeral. Are funeral expenses deductible on Form 1041.

It was 117 million in 2021 1206 million in 2022 at the federal level while its only 1 million in Oregon. Estates try to claim. Conditions for Cremation Tax Deductibility.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. So a 25 souvenir death DVD would no longer cost 25 but 2706. Many estates do not actually use.

Funeral expenses are not tax deductible because they are not qualified medical expenses. A death benefit is income of either the estate or the beneficiary who receives it. Are funeral expenses tax deductible.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or. However only estates worth over 1206 million are eligible for these tax. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes.

If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Were trying to consider things about a.

Expenses that exceed 75 of your federal AGI.

The 12 Stages Of The Probate Process In California

Survivor Universal Life Insurance 4088541883 San Jose California Conn

Ca 2022 2023 Budget Ends Nol Deductions Business Credits Suspensions

Health Access Ca Healthaccess Twitter

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Survivor Universal Life Insurance 4088541883 San Jose California Conn

Are Funeral Expenses Tax Deductible

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

What Is A Typical Wrongful Death Settlement In California

How Much Does A Funeral Cost Forbes Advisor

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Sample Business Letter Check More At Https Cleverhippo Org Sample Business Letter

Look Out For Marketing Form Disguised As Tax Document

Will I Be Reimbursed For Legal Expenses After Probate In California

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)